On Tuesday, 29th March, Federal Treasurer Josh Frydenberg delivered the 2022/23 Federal Budget, focused on supporting Australians against the rising cost of living, and build the post-pandemic recovery for the economy as this begins to take shape.

In an Election-year Budget, Treasury highlighted the reforms at Individual and Business levels to come into effect following Royal Assent, with remit to introduce greater increases to the Low-and-Middle Income Tax Offset, temporary reduction in fuel excise duty, one-off support for cost-of-living expenses, business technology and skills financial “boosts”, greater streamlined compliance reporting for businesses, and other measures to assist industry.

In this report, we breakdown the main measures released as part of the ‘Australian Federal Budget – 2022/23’.

Personal Taxation |

Increase in the Low-and-Middle Income Tax Offset (LMITO)

This year’s Budget highlighted the delivery of additional Personal Income Tax relief, with the extension of the Low-and-Middle Income Tax Offset (LMITO) designed to support individual Australians and assist with cost-of-living pressures.

Under the proposal, the extension will see an increase to the LMITO by $420 for the 2021-22 Income Year. This increases the maximum LMITO benefit in 2021-22 to $1,500 for individuals and $3,000 for couples. The increased LMITO benefit for the 2021-22 Income Year will be paid from 1 July 2022, following

Australian’s lodging their Individual Tax Return.

All LMITO recipients will benefit from the increase, except those that do not require the full offset to reduce their tax liability to zero. All other features of the current LMITO remain unchanged and is legislated to cease after this year.

Furthermore, consistent with the current LMITO, taxpayers with incomes of $126,000 or more will not receive the additional $420 benefit.

Personal Tax Rates unchanged for 2022-23

In the Budget, the Government did not announce any personal tax rates changes. The Stage 3 tax changes commence from 1 July 2024, as previously legislated. The 2022–2023 tax rates and income thresholds for residents are unchanged from 2021–2022:

- Taxable Income up to $18,200 – nil;

- Taxable Income of $18,201 to $45,000 – 19% of excess over $18,200;

- Taxable Income of $45,001 to $120,000 – $5,092 plus 32.5% of excess over $45,000;

- Taxable Income of $120,001 to $180,000 – $29,467 plus 37% of excess over $120,000; and Taxable Income of more than $180,001 – $51,667 plus 45% of excess over $180,000.

** Please note, the above tax rates do not include the Medicare Levy of 2%

Cost-of-Living Payment

The Federal Government will provide a one-off $250 cost-of-living payment to help eligible recipients with high cost of living pressures. The payment will be made in April 2022 to eligible recipients of the following payments and to Concession Cardholders:

- Age Pension

- Disability Support Pension

- Parenting Payment

- Carer Payment

- Carer Allowance (if not a recipient of a primary income support payment)

- JobSeeker Payment

- Eligible Veterans' Affairs payment recipients & Veteran Gold Card holders

- Youth Allowance

- Austudy & Abstudy Living Allowance

- Double Orphan Pension

- Special Benefit

- Farm Household Allowance

- Pension Concession Card holders

- Commonwealth Seniors Health Care holders

The payments are exempt from tax and will not count as income support for the purposes of any income support payment. A person can only receive one economic support payment, even if they are eligible under two or more categories outlined above.

The payments are exempt from tax and will not count as income support for the purposes of any income support payment. A person can only receive one economic support payment, even if they are eligible under two or more categories outlined above.

Temporary Reduction in Fuel Excise Duty

The Excise and Excise-Equivalent Customs (EEC) Duty rate that applies to petrol and diesel will be halved for six-months.

The measure will commence from 12:01am on 30 March 2022 and will remain in place for six-months, ending at 11:59pm on 28th September 2022. At the conclusion of the six-month period the Excise and EEC duty rates will then revert to the previous rates, including indexation that would have occurred on those rates during the six-month period.

The rate of Excise and EEC duty currently applying to petrol and diesel will fall from 44.2 cents per litre to 22.1 cents per litre.

The temporary reduction in excise duty for fuel will also have an impact for businesses, resulting in a reduction in any corresponding fuel tax credit entitlements.

Under the Fuel Tax Credits program, businesses are entitled to claim full or partial credit for fuel used in carrying on their business - utilsiing plant & machinery equipment or heavy vehicles & light vehicles over 4.5 tonnes gross vehicle mass travelling off public roads or on private roads.

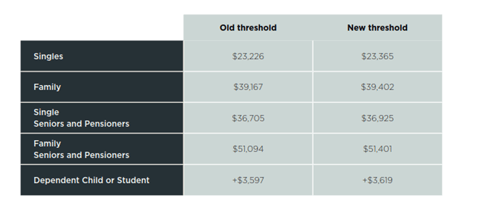

Increasing the Medicare Levy Low-Income Threshold

The Medicare Levy Low-Income thresholds for Senior, Pensioners, Families, and Singles will be increased from 1 July 2021. The increase in the thresholds take account of recent movements in the Consumer Price Index so that low-income individuals continue to be exempt from paying the Medicare Levy.

Business Taxation |

Skills and Training Boost for Businesses

Small businesses (with aggregated annual turnover of less than $50 million) will be able to deduct an additional 20 per cent of expenditure incurred on external training courses provided to their employees. The external training courses will need to be provided to employees in Australia or online, and delivered by entities registered in Australia.

Some exclusions will apply, such as for in-house or on-the-job training and expenditure on external training courses for persons other than employees.

The boost for eligible expenditure incurred by 30 June 2022 will be claimed in the FY2023 Tax Return. The boost for eligible expenditure incurred between 1 July 2022 and 30 June 2024, will be included in the income year in which the expenditure is incurred.

The boost will apply to eligible expenditure incurred from 7:30pm (AEDT) on 29 March 2022 until 30 June 2024.

Technology Investment Boost for Businesses

Small businesses (with aggregated annual turnover of less than $50 million) will be able to deduct an additional 20 per cent of the cost incurred on business expenses and depreciating assets that support their digital adoption, such as portable payment devices, cyber security systems or subscriptions to cloud-based services.

An annual cap will apply in each qualifying income year so that expenditure up to $100,000 will be eligible for the boost.

The boost for eligible expenditure incurred by 30 June 2022 will be claimed in the Financial Year 2023 Tax Returns. The boost for eligible expenditure incurred between 1 July 2022 and 30 June 2023 will be included in the income year in which the expenditure is incurred.

The boost will apply to eligible expenditure incurred from 7:30pm (AEDT) on 29 March 2022 until 30 June 2023.

Expanding Access to Employee Share Schemes

The 2022/23 Federal Budget announced the Government’s intention to expand access and further reduce red-tape, so that employees at all levels can directly share in the business growth they help to generate.

Where employers make larger offers in connection with Employee Share Schemes in unlisted companies, participants can invest up to:

- $30,000 per participant per year, accruable for unexercised options for up to five years, plus 70% of dividends and cash bonuses; or

- any amount, if it would allow them to immediately take advantage of a planned sale or listing of the company to sell their purchased interests at a profit.

The proposed changes to the regulatory framework will enable more ESS awards to be issued to employees at all levels, including to independent contractors. While the proposed changes are likely to be particularly beneficial for start-up organisations, they should also be of assistance to more established companies.

Patent Box Income Extended

The Government will expand its patent box tax regime from only applying to the medical and biotechnology sectors to also include the agricultural sector, and low emissions technology innovations.

In line with the initial May 2021 announcement and subsequent draft legislation introduced in February 2022, this regime will effectively result in a concessional tax rate of 17% for ordinary income derived from exploiting Australian-owned and developed patents that fall under these areas This represents a decrease in the corporate tax rate of 13% for large businesses and 8% for small and medium enterprises.

However, it is important to note, unlike the medical and biotechnology sectors for which the regime will apply from 1 July 2022, the expanded application to the agricultural sector, and low emissions technology innovations, will only apply from 1 July 2023 In addition, details of the expansion of the patent box regime are yet to be finalised, pending consultation with industry experts

Reporting of Taxable Payments Reporting System Data

The Government will provide businesses with the option to report Taxable Payments Reporting System data (via accounting software) on the same lodgment cycle as their activity statements.

Subject to advice from software providers about their capacity to deliver, it is anticipated that systems will be in place by 31 December 2023, with the measure to commence on 1 January 2024, for application to periods starting on or after that date.

Modernising the PAYG Instalment System

The Federal Government has announced that companies can choose to have their Pay-As-You-Go (PAYG) Instalments calculated based on current financial performance, extracted from business accounting software, with some tax adjustments.

Subject to advice from software providers about the capability to deliver, it is anticipated that systems will be in place by December 2023, with the measure scheduled to commence from 1 January 2024.

The Gross Domestic Product (GDP) uplift rate that applies to PAYG instalments and GST instalments will be set at a flat 2% for the 2022/23 Income Year. The 2% uplift rate will apply to instalments for the 2022/23 Income Year that fall due after the legislation receives Royal Assent.

The 2% rate will be available to small-to-medium businesses that have an aggregate turnover of less than $50 million for PAYG and $10 million for GST instalments.

Sharing of Single Touch Payroll Data

The Government has committed to the development of IT infrastructure required to allow the ATO to share STP data with State and Territory Revenue Offices on an ongoing basis.

Funding for this measure has already been provided and will be deployed following consideration of which States and Territories are able, and willing, to make investments in their own systems and administrative processes to pre-fill payroll tax returns with STP data.

Superannuation |

Extension of Temporary Reduction in Superannuation Minimum Drawdown Rates

The Federal Government has announced an extension of the 50% temporary reduction in Superannuation Minimum Drawdown Rates for a further year to 30 June 2023.

The Minimum Drawdown requirements determine the minimum amount of a pension that a retiree must draw from their Superannuation in order to qualify for tax concessions.

The measure was first introduced in the 2020 Financial Year in response to the COVID-19's impact on investment markets and allows pension members to withdraw less of their retirement savings, leaving a greater amount invested for the future.

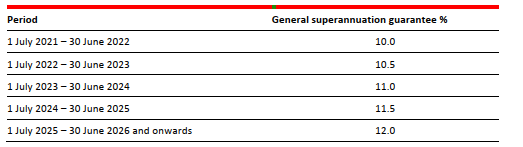

Superannuation Guarantee

There were no changes to the legislated rates of superannuation guarantee. The rates as legislated are as follows:

Paid Parental Leave

Building on the Women’s Economic Security Package announced in the 2021-22 Federal Budget, the Government has announced changes to enhance the Paid Parental Leave Scheme and improve economic security for women.

This scheme rolls Dad and Partner Pay into a single Parental Leave pay scheme of up to 20 weeks, which is fully flexible and able to be shared between eligible working parents as they see fit. The Government says its paid parental leave changes, costing $346.1 million over five years, will give families the opportunity to take leave any time within two years of the birth or adoption of the child.

Further, the Government has promised this will not result in any existing eligible applicants being worse off. This notion is supported by an expanded eligibility household income means test of $350,000 (previously restricted to mothers earning less than $150,000 per annum) to access the taxpayer-funded leave.

Assistance to Help Single Parents save for a Home Deposit

The Government is expanding its Home Guarantee Scheme to 50,000 places per year at a cost of $8.6 million. This scheme provides an 18% guarantee on the purchase price of a home, allowing people to purchase a home with a 2% deposit. It has also expanded the Family Home Guarantee, which reserves spots in the scheme for single parents with dependent children, to 5,000 places per year (up from 2,500) through to 2024-25. To date, the Family Home Guarantee has supported 1,940 single parents into homeownership, 85% of whom have been single mothers.

This scheme is targeted at helping single parents, particularly single working mothers (being the majority of single parents) to enter or re-enter the housing market. The scheme is not limited to first-home buyers and will therefore allow single parents who are re-entering the housing market after a divorce or family breakdown to also benefit.

The Government also announced an $2 billion increase in the National Housing Finance and Investment Corporation’s lending cap to $5.5 billion. The Government expects this to support around 8,000 more social and affordable dwellings for vulnerable Australians.

For More Information

For more information on the 2022/23 Federal Budget and how it will impact you or your SME business, please contact your Archer Gowland Redshaw adviser on (07) 3002 2699 | info@agredshaw.com.au

%20-%20HubSpot%20(1).png)