As of 1 July 2022, new legislation has now taken effect which details the Australian Tax Office’s compliance approach to the allocation of profits or income from Professional Firms as assessable income to the ‘Individual Professional Practitioner’ (IPP).

The legislation provides clarity on how distributions of income from professional firms can be made to the person earning the income and the remaining members of the family group – which can include Trusts, Companies, and lower income beneficiaries like spouses and adult children.

Under the legislation, the ATO has defined a “Professional Firm” to include (but not limited to) those providing services in accounting, legal, engineering, architectural, financial services, and medical professions.

The new guidelines require Individual Professional Practitioners to determine a risk rating associated with the allocation of profits received from the professional firm between the professional practitioners and their related parties.

Determining the Risk Rating

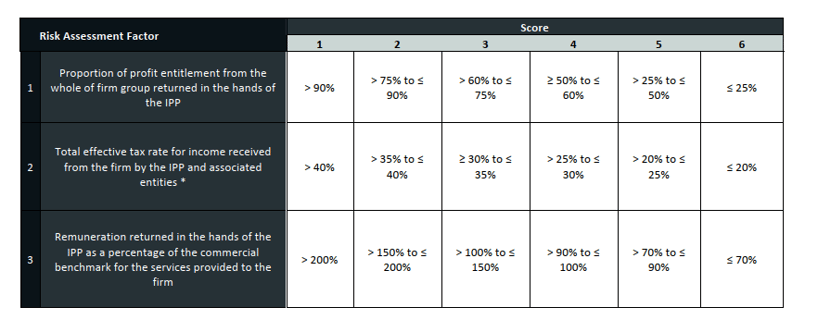

The ATO has developed a risk-matrix & risk-score criteria, allocating points to certain benchmark factors surrounding proportion of profit, tax rate, and commercial remuneration in order to determine three risk profiles.

These risk profiles are defined as follows:

| Green / Low Risk |

|

| Amber / Moderate Risk |

|

| Red / High Risk |

|

Gateway Tests

In calculating the risk-score, Professional Firms will be first required to assess their arrangements against initial “gateways”, determining commercial rationale and confirmation of nil high-risk features.

The below highlights each ‘gateway’ test and definition in greater detail.

Gateway 1

The first gateway test assesses that the current arrangement has a genuine commercial rationale for the business structure and the way in which profits are distributed (especially in the form of paid remuneration) and reflects the commercial needs of the business.

There must be evidence that the stated commercial purpose/arrangement achieves an objective or result, pertaining to overall business improvement.

As per the ATO, any arrangement that shows a lack of commercial rationale may include:

- seems more complex than necessary to achieve the relevant commercial objective

- appears to serve no real purpose other than to gain a tax advantage

- has a tax result that appears to be at odds with its commercial or economic result

- results in little or no risk in circumstances where significant risks would normally be expected

- operates on no-commercial terms or in a non-arm’s length manner

- presents a gap between the substance of what is being achieved and the legal form it takes.

Gateway 2

The further gateway test (Gateway Two) requires an assessment of where there are any ‘high-risk’ features.

As per the ATO, arrangements with ‘high-risk’ features, can include:

- having financing arrangements relation to non-arm's length transactions

- exploiting the difference between accounting standards and tax law

- being materially different in principle from Everett and Galland (refer to Everett assignments for information on high-risk features of Everett assignments)

- involving multiple classes of shares and units, including creating discretionary entitlements such as dividend access shares

- involving multiple assignments or disposals of an equity interest

- misuse of the superannuation system, including assignments or disposals of an interest to associated self-managed super funds (SMSFs)

- distributing income to entities, other than the IPP, with losses

Process of Self-Assessing

Where both ‘Gateway One’ & ‘Gateway Two’ are satisfied, you may self-assess your profit arrangement to determine a risk rating, which combines the scores of the first two risk assessment factors below, and if appropriate, factor three (although factor three is optional).

- Proportion of profit entitlement from the whole of Firm group returned in the hands of the IPP

- Total effective tax rate for income received from the Firm by the IPP and associated entities

- Remuneration returned in the hands of the IPP as percentage of the commercial benchmark for the services provided to the Firm

As such, the resulting ‘score’ will determine your overall risk assessment.

| Risk Zone | Risk Level | Aggregate Score against first two factors | Aggregate of all three factors |

| Green | Low Risk | 7 | 10 |

| Amber | Moderate Risk | 8 | 11 & 12 |

| Red | High Risk | 9 | 13 |

Case Study

Karl is an Individual Professional Practitioner in Our Town Lawyers, which operates as a partnership of discretionary trusts with five equal discretionary trust partners and 12 employees.

Karl’s discretionary trust receives $800,000 as its share of profit from Our Town Lawyers. The Trust distributes the income as follows:

- $500,000 to Karl

- $150,000 to Annika (Karl’s wife)

- $150,000 to KA Pty Ltd (a Company controlled by Karl & Annika)

The risk assessment is:

| Risk Assessment Factor | Application Criteria | Score |

| Proportion of Profit Entitlement from the whole of firm group returned in the hands of the IPP | $500,000 of $800,000 results in 62.5% of the IPP’s profit entitlement from the firm group being returned by Karl personally | 3 |

| Total effective tax rate for income received from the firm by the IPP and associated entities |

Karl pays tax of $195,667 on the $500,000 income distributed to him. Annika pays tax of $40,567 on the $150,000 income distributed to her. KA Pty Ltd pays tax of $45,000 of the $150,000 distributed to it. The effective rate of tax is calculated as follows: ($195,667 + $40,567 + $45,000) / ($500,000 + $150,000 + $150,000) x 100 = 35.15% |

4 |

| Remuneration returned in the hands of the IPP as a percentage of the commercial benchmark for services provided to the firm |

Not applicable. Karl determines that it is impractical to accurately determine an appropriate commercial remuneration. |

- |

| Total |

|

7 |

What you may need to do to structure your Arrangements accordingly?

The ATO requires Individual Professional Practitioners to self-assess their risk annually and keep documentary evidence of this assessment. The ATO may request this evidence if they were to review the IPPs situation.

Please note, whilst some individual practitioners may qualify for a ‘grace period’ up until 30 June 2023 to modify existing arrangements and lower their risk appetite, it is important to have your business structure reviewed by a trusted tax adviser to ensure compliance with the legislation and avoid scrutiny by the ATO.

For More Information

For more information on the new legislation and how to self-assess against the above gateway tests and risk score, please contact the Archer Gowland Redshaw adviser team on (07) 3002 2699 | info@agredshaw.com.au

%20-%20HubSpot.png)