Regardless of industry, the upcoming New Financial Year presents an ideal opportunity for business owners to review the results of the previous 12 months and begin formulating a plan for the fiscal year ahead.

One of the most common issues raised by business owners during this time of year surrounds the question of building "continuous workflow, prospect inquiry, and increased strategy towards revenue & business growth" throughout the Financial Year.

As the economy continues its post-pandemic trajectory, it is important to ensure that business plans are documented to help act as a guide into the future. The latest business insights outline only 26% of small-to-medium business operators are engaged in regular business planning, with only six per cent of operators having a comprehensive plan, which is current and actively managed.

As such, we've outlined the areas to consider as part of developing a one-page business plan, and how clarification in formulating your approach can support your business moving forward.

Ensure you have your Goals / Objectives & Action Plan in place for the next 12 months

As a business owner, it can become easy to focus on the day-to-day operational duties without considering your overall business goals and objectives.

It is key you review your current mission statement for the year, business goals & objectives, and overall strategy - ensuring they align with current economic and business conditions, whilst also reflecting the direction in which your business is heading. It is important to recognise that your original business plan may have become outdated and no longer accurately represents the strategies relevant to your current requirements.

So, how do I realign my business goals with the current direction of my business? It is important when re-evaluating you consider the following criteria:

| Specific | Make your goals / objectives specific and narrow for more effective planning |

| Measurable | Define how you will measure progress and re-evaluate when/where necessary |

| Achievable | Make sure you can reasonably accomplish your goal(s) within a certain timeframe |

| Realistic | Your goal(s) should align with your values and long-term objectives |

| Timely | Set a realistic, end-date by when they need to be achieved |

Building a new business plan for the current Financial Year doesn't have to be complicated or a lengthy procedure. Your Action Plan can only be a single-page, but creating this will help in defining their core strategy, value proposition, and important business metrics. Together, this will help drive accountability, purpose, and outcomes across the 12-month period ahead.

If you are unsure where to begin when piecing together an extended business plan, contact a professional adviser such as Archer Gowland Redshaw, who will be able to assist through Business Advisory services.

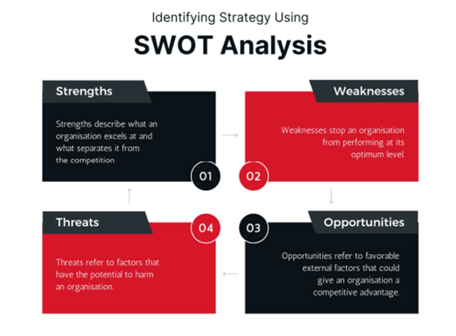

Conduct a SWOT Analysis

Equally, time should be taken to consider the internal and external Strengths, Weaknesses, Opportunities, and Threats (SWOT) associated with your business.

Today's fast-paced business environment is ever-changing, therefore the need to maintain a competitive advantage is vitally important.

Today's fast-paced business environment is ever-changing, therefore the need to maintain a competitive advantage is vitally important.

It is also important that your business can respond and adapt in changing economic circumstances, therefore a detailed SWOT analysis can help in determining appropriate strategies to mitigate any potential risks.

You should look to keep your SWOT analysis regularly updated - reflecting the various changes occurring within your industry and external factors which could influence change in business decisions & direction.

As business advisers, we recommend you reflect and amend your SWOT analysis every quarter or on a half-yearly basis where necessary.

Furthermore, in conducting a thorough SWOT analysis, you may gain greater clarification of potential marketing drivers for the business. Doing so, will help identify opportunities within the marketplace, appropriate strategies (such as the 4P’s: Product, Promotion, Price, and Place), and avenues for future sales targets or expansion programs.

Ensure you have strong understanding of Financial performance and build a Financial Analysis

When forming your business plan, it is important to consider the financial performance of the business and have an in-depth understanding of the financial drivers associated.

In reviewing financial performance of the past 12-months, you should establish insights into:

- Overall performance of products / services;

- Best performing products or most profitable service offering;

- What forms your overall revenue mix; and

- Expenses, direct costs, and cost of sales

By considering these metrics, alongside potential micro & macro-environmental factors such as loss of customers or any lingering impacts of the COVID-19 pandemic – you gain greater clarification towards defining future projections.

As a business owner, you should implement Key Performance Indicators – which highlight targets involving Revenue, Gross Profit, Expenses, and Net Profit. Likewise, you should have a strong understanding of the businesses’ cash-flow and the various periods where money is coming in and out of the business.

As business advisers, we suggest conducting a cash-flow analysis/projection every quarter to provide the greatest clarity. Should you require assistance in building a detailed cash-flow, an accountant (such as Archer Gowland Redshaw) can support you in doing so.

12-Month Implementation Strategy

Once you have formulated your business plan - defining your goals and completing a SWOT and financial analysis - the next stage turns to the implementation of necessary changes.

In order to commence with changes, create an implementation plan to define the project.

The plan should be designed to help you and your team evaluate each stage in the change process, as well as allocate selected to tasks to individuals or departments to assist with overall redevelopment.

Having a defined implementation plan will also create accountability and ensure each stage is completed in-line with expectation.

Remember, not everything has to be completed at once, however you should always allocate a start & finish date to each stage as an estimated guide.

As you begin to implement new areas in-line with your project plan, track and report on various changes, readjusting where applicable. By monitoring and reviewing as these occur, you will have a greater understanding of how the changes impact your business, as well as day-to-day operations over the long-term.

For More Information

For more information on formulating your one-page business plan, or to book a free consultation, please contact Smiljan Jankovic – Managing Director, Archer Gowland Redshaw on (07) 3002 2699 | smiljanj@agredshaw.com.au.