On Tuesday, 9th May, Federal Treasurer Hon. Jim Chalmers handed down the 2023/24 Federal Budget, a second delivered by the Albanese Government, providing an outlook into the Government's priority to create a "responsible and sustainable" economic strategy, in the face of continued inflation, rising cost-of-living, and global volatility.

Acknowledged as being the beginning of a multi-Budget Treasury plan to return the Australian economy back to a sustained and reoccurring surplus, the 2023/24 Budget revealed a predicted surplus forecast for the 2022/23 Financial Year - a first in 15 years.

The announced measures aim to balance appropriate restraint by the Federal Government, whilst addressing three key focuses of cost-of-living relief, growing the economy, and ensuring Australia's economic resilience. The measures also work to assist Australian's financially against continued slow financial growth and uncertainty.

In our latest Insights, we breakdown the main measures of the 2023/24 Federal Budget and how these changes affect you and your SME business:

Individual Taxation Measures & Assistance |

Energy Bill Price Rebate / Relief

One of the key policies to be announced as part of this years' Budget pertains to cost-of-living relief for rising electricity and gas bills for households and small businesses.

Under the $3 billion package, from July 2023, eligible households in New South Wales, Victoria, Queensland, South Australia and Tasmania will receive up to a $500 rebate against their gas or electricity bill.

Those eligible households in Western Australia, Northern Territory, and the Australian Capital Territory will receive a rebate of up to $350.

The Energy Bill Relief package aims to support those in "greatest need", which includes pensioners, Commonwealth Seniors Health Card holders, Family Tax Benefit A and B recipients, and small business customers of electricity providers.

Greater Access to Cheaper Medicines

As announced ahead of the Federal Budget address, Australians will be able to buy two months’ worth of medicine for the price of a single (one month) prescription for more than 300 common PBS medicines.

Medicines to treat COVID-19 and cystic fibrosis are also being expanded or added to the PBS program.

Increasing the Medicare Levy Low-Income Thresholds

The Government will increase the Medicare levy low-income thresholds for singles, families and senior & pensioners from 1 July 2022.

The thresholds will be increased as follows:

- for singles - from $23,365 to $24,276;

- for families - from $39,402 to $40,939;

- for single pensioners and singles - from $36,925 to $38,365; and

- for family pensioners and singles - from $51,401 to $53,406.

For each dependent child or student, the family income thresholds will increase by a further $3,760.

Expansion to First Home Guarantee Scheme

Ahead of the Federal Budget's official release, the Labor Government confirmed the expansion of its eligibility criteria for access to the Home Guarantee Scheme, in an attempt to address the housing affordability crisis and widening the ability for Australia's to access the property market.

Under the changes, from 1 July, "eligible individuals" (categorised as friends, siblings, and other family members) will be able to jointly apply for the First Home Guarantee and Regional First Home Guarantee schemes.

Prior to the announcement, eligibility criteria were restricted to married and single people, and those in de-facto relationships.

Via the program, the Federal Government will act as a guarantor on up to 15 per cent of a home loan. In doing so, this enables eligible home buyers to purchase a property with a 5 per cent deposit, without the need to pay Lenders Mortgage Insurance.

Additionally, as part of the extended eligibility criteria, access to each scheme will also be made available to Permanent Residents, in addition to full Australian citizens.

Federal Budget Measures for Businesses |

Temporary Changes to Small Business Instant Asset Write-Off

From 1 July 2023 until 30 June 2024, the Government will temporarily increase the Instant Asset Write-Off Threshold from $1,000 to $20,000.

Small businesses with an aggregated annual turnover of less than $10 million will be able to immediately deduct the full cost of eligible assets costing less than $20,000 that are first-used or installed ready for use between 1 July 2023 and 30 June 2024. The $20,000 threshold will apply on a per-asset basis, so small businesses can instantly write-off multiple assets.

Assets valued at $20,000 or more (which cannot be immediately deducted) can continue to be placed into the small business simplified depreciation pool and depreciated at 15% in the first income year and 30% each year thereafter.

The provisions that prevent small businesses from re-entering the simplified depreciation regime for five years if they opt-out will continue to be suspended until 30 June 2024.

No Changes to 2024 Stage Three Tax Cuts

As highlighted prior to Budget release, the Federal Government did not announce any extensions to the Stage Three Low & Middle Income Tax Offsets. No changes were also announced as part of the Budget for the Low Income Tax Offset category - with this remaining unchanged for the 2023/24 Year.

Small Business GDP Uplift Factor changes to GST & PAYG instalments

As part of the Budget papers, the Federal Government announced cash flow support for small businesses via adjustment factors attached to Pay-As-You-Go (PAYG) and GST Instalments.

Under the support package, a six per cent Gross Domestic Product (GDP) adjustment factor will be applied for the 2023-24 Income Year, halving the current arrangement of 12 per cent for the current statutory formula.

To be eligible for the adjustment, businesses must already fall under the current PAYG and GST instalment thresholds of $50 million and $10 million in aggregate turnover.

The introduction of the measure aims to "strike a balance between improving cash flow for small businesses and managing income tax and GST liabilities".

Small Business Energy Incentive - Green Investment for Small Businesses

Announced prior to the Federal Budget by Treasurer Jim Chalmers, small-to-medium businesses that invest in energy efficient equipment could be eligible for a tax deduction of up to $20,000.

Under the newly introduced Small Business Energy Incentive, businesses with a turnover of up to $50 million will be eligible for a tax deduction where investment is made in energy efficient processes - such as electrifying cooling and heating systems, installing batteries and heat pumps, and upgrading fridges and other appliances to better energy rate products.

The incentive offers an additional 20% tax deduction of cost (with a maximum tax deduction bonus being $20,000) eligible assets or upgrades needed, first-used or installed ready for use between 1 July 2023 and 30 June 2024.

Sunset FBT Exemption for Electric Cars

The Government has decided to remove the Fringe Benefit Tax exemption for plug-in hybrid electric cars, with effect from 1 April 2025.

Any agreements or contracts made for such vehicles between 1 July 2022 to 31 March 2025 will still qualify for the electric car discount.

The "sunsetting" of this legislation is an extension of the Treasury Laws Amendment (Electric Car Discount) Bill 2022, which received Royal Assent in December 2022.

Proposed Changes to Petroleum Resource Rent Tax (PRRT)

From 1 July 2023, new changes will be introduced to the Petroleum Resource Rent Tax (PRRT), with a cap on the use of deductions for offshore projects.

The cap will limit the proportion of PRRT assessable income that can be offset by deductions to 90 per cent.

A corporate tax measure, PRRT is generally on profits generated from the sale of marketable petroleum commodities - including:

- stabilised crude oil

- sales gas

- condensate

- liquefied petroleum gas

- ethane

- shale oil

Where the proposed legislation receives Royal Assent from Parliament, the changes will look to bring forward tax revenue originally due in 2030 and onwards of an estimated $2.4 billion over four years.

Build-to-Rent (BTR) Tax Changes & Foreign Investment

The Australian Government has announced several measures in the 2023/24 Budget to boost the country's housing supply, with a particular focus on new build-to-rent (BTR) projects and affordable housing programs.

To encourage foreign investment in Australian BTR projects and increase the supply of rental housing, especially affordable rental housing, the Government has reduced the withholding tax from 30% to 15% on distributions from eligible residential BTR projects.

The measure will take effect from 1 July 2024 and is expected to benefit both investors and tenants. This could potentially lead to a considerable increase in foreign investment in the sector.

In addition, there is an incentive to accelerate the capital works deduction for BTR projects. The capital works deduction rate will increase from 2.5% to 4% for construction commencing after 9 May 2023. This means that (BTR) projects will provide investors with higher tax-free returns of capital at the early stages of the project as well as improving the cash flow.

To be eligible, buildings must have at least 50 apartments, minimum three-year leases, and single ownership for 10 years.

Introduction of a Small Business Lodgment Penalty Amnesty

As part of the major tax measures announced in the 2023/24 Federal Budget, small businesses with an aggregated turnover of less than $10 million will be granted a Small Business Lodgment Penalty Amnesty.

The introduction of the amnesty is aimed at encouraging small businesses to re-engage with the tax system and ensure their compliance obligations are up-to-date.

The amnesty will remit failure-to-lodge penalties for outstanding tax statements lodged in the period from 1 July 2023 to 31 December 2023, that were originally due between 1 December 2019 to 29 February 2022.

To be eligible for the amnesty, small businesses must, at the time of lodgment, be an entity with an aggregated turnover of less than $10 million.

Four Year Extension for GST Compliance Program

The Government will provide $588.8 million to the Australian Tax Office over four years from 1 July 2023 to continue a range of activities that promote GST compliance.

These activities will ensure businesses meet their tax obligations, including accurately accounting for and remitting GST, and correctly claiming GST refunds. Funding through this extension will also help the ATO to develop more sophisticated analytical tools to combat emerging risks to the GST system.

Superannuation & Retirement |

Superannuation Tax on Funds above $3 million

The Government is moving forward with measures to cut back tax concessions for those with a total superannuation balance exceeding $3 million, effective from 1 July 2025.

This strategy aims to make superannuation concessions more focused and sustainable, increasing the headline tax rate from 15% to 30% for earnings that exceed an individuals' total superannuation balance of $3 million.

The Government has also clarified that for fund assets below the $3 million threshold, the tax rate will remain at 15% or potentially 0.5% if the funds are in a retirement phase pension account.

Announced prior to the 9 May Budget address, no new information was revealed on the night.

Superannuation "Payday" in-line with Salary & Wages

Announced ahead of Budget night, from 1 July 2026, employers will be required to pay superannuation payments for employees on "payday" - meaning at the same time as ordinary salary and wages.

Under current legislation, employers are required to pay Superannuation Guarantee Contributions into employees' nominated funds every quarter. The new change (yet to receive Royal Assent) aims to better off the average worker in retirement by providing more time for compounding interest due to greater frequency of payments.

Additionally, in introducing the new change, the Labor Government aims to crackdown on unpaid superannuation payments owing to employees, with the Australian Tax Office also to receive greater resources to detect unpaid super payment earlier.

No Change to Minimum Pension Drawdowns for 2023/24

The 2023/24 Federal Budget did not announce any further extension to the temporary 50% reduction in the minimum annual payment amounts for Superannuation pensions and annuities.

Introduced in the 2020 Budget to assist against the impacts of the global COVID-19 pandemic and applied to the 2019-20 to 2022-23 income years, the minimum pension drawdowns reduction is set to conclude at 30 June 2023.

Superannuation trustees and members will need to start planning for the additional cash flow requirements to satisfy the minimum annual payment amounts for 2023-24.

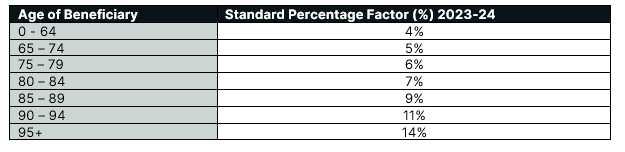

Minimum annual payment amounts for the 2023-24 year are determined by age of the beneficiary and the value of the account balance as at 1 July each year.

The table below highlights the standard percentage factor payment per relevant age in the Financial Year:

Other Industry Measures |

Greater Workplace Accessibility for Employees with Disabilities

To make workplace more accessible for those with disabilities, the Federal Government is raising funding caps for the Employment Assistance Fund - a first in over 10 years.

The Employment Assistance Fund provides businesses financial assistance to purchase work-related equipment, secure Auslan services, and support services to assist workers with a disability in the workplace.

Funding caps will increase for Auslan services - raising from $6,000 to $12,000 annually, whilst the Building Modification Cap will be doubled from $30,000 to $60,000.

Tobacco Tax to Increase from 1 September 2023

Announced ahead of the Budget, from 1 September 2023, new excise tax measures on tobacco products will be introduced – with the change highlighting tax increases of five per cent per year until 2026.

In addition to increased excise tax measures, from September, ‘loose-leaf’ and ‘roll-your-own’ tobacco products will also be taxed in the same way as cigarettes.

The introduction of these new tax reforms will account for $290 million in Good-and-Services Tax payments to States and Territories across the period. The additional tax revenue will be reinvested into Australia’s health system to help support cigarette-users to quit as well as a new public health campaign to discourage Australians from taking up vaping, smoking, and other such programs.

The proposed measures will be legislated following receiving Royal Assent.

Aged Care Award Wage Reform to provide frontline workers with greater pay

Revealed prior to the Budget release date, the Federal Government has announced its commitment to $11.3 billion in funding to reform Award Wage rates for frontline workers in the Aged Care sector.

Under changes to Award Wage rates, frontline workers within Aged Care will receive a 15% pay rise, aimed at helping ease increasing cost-of-living expenses, as well as attracting new workers to the industry.

The commitment to funding over four years aims to assist more than 250,000 workers in the sector across enrolled nurse, nursing assistant, head chef and cook positions.

The changes will take effect from 1 July 2023 – following Royal Assent from Parliament.

Further Investment in Electric Vehicle Charging Stations across Australia

Through the Federal Government's Driving the Nation Fund, Labor has committed to provide $39.3 million to National Roads & Motorists' Association (NRMA) - who will match the funding - to build 117 fast electric vehicles charging stations across Australia's national highways.

In furthering EV charging infrastructure, Australian's will have greater opportunities to travel further distances, such as Darwin to Perth, Broken Hill to Adelaide, and Brisbane to Tennant Creek.

Additionally, the increase in readily-available charging stations is believed to ease the barrier to purchasing an electric vehicle, where concerns surround battery range during travel.

Increase Infrastructure Spending on Australian Roads

The Federal Government has announced increased funding for it's Black Spot Program - providing further safety measures and road upgrades in Western Australia and Queensland.

As part of the program, Queensland will receive $21.7 million for further investment and upgrades to 38 identified road incident sites.

Greater Support for Young People Carers

Young people aged 12 to 25 who are caring for a loved one will get a cash boost of $768 in order to continue their education.

The Government has committed to providing an additional $10 million funding increase to Carers Australia's Young Carer Bursary Program. As a result, bursary payments will increase from $3,000 to $3,768.

Announced as part of the changes, the number bursaries offered will also increase year-on-year between 2023 to 2025.

For More Information

For more information on anything released as part of the 2023/24 Federal Budget, please contact the Archer Gowland Redshaw team on (07) 3002 26499.

%20-%20HubSpot%20(1).png)