On Tuesday, 25th October, Federal Treasurer Jim Chalmers handed down the 2022/23 Albanese Government - Federal Budget, providing a brief introduction into Labor's priorities to steady the peak of inflation and manage Australia's economic deficit.

The Treasury plan announced aims to implement "responsible" support measures without adding to inflation and set a five-point plan for cost-of-living relief across child-care, healthcare & medicines, housing, potential wage growth, and support for families.

For individual taxpayers and businesses, the Federal Government's announcement for proposed new tax reforms were minimal, however further boosts were given to tax collection measures at enterprise level.

In our latest Insights, we breakdown the main measures released as part of the ‘Albanese Government Federal Budget – October 2022/23’.

Support for Individuals |

Low-and-Middle Income Tax Offset (LMITO) Not Extended to 2022-23

October's Budget release confirmed there will be no further extension to the Low-and-Middle Income Tax Offset (LMITO) into Financial Year 2022-23.

The LNP Government's March fiscal strategy extended the LMITO support measure by $420 for the 2021-22 Income Year, providing a maximum benefit to $1,500 for individuals and $3,000 for couples.

The Low Income Tax Offset (LITO) remains unchanged for 2022-23, having previously been brought forward in 2020 to apply from 2020-21 Income Year. The maximum offset available is up to $700 and applies to taxable incomes between $45,000 and $66,667.

Personal Tax Rates Unchanged for 2022-23

In a similar approach to the March Budget, the Albanese Government did not announce any new changes to personal tax rates and income thresholds for residents.

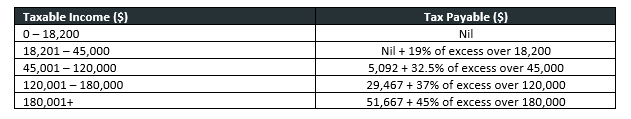

As a result, taxable income rates remain at:

Alongside this, intended changes to the Stage Three personal income tax are still scheduled to commence from 1 July 2024, as previously legislated with no additional amendments.

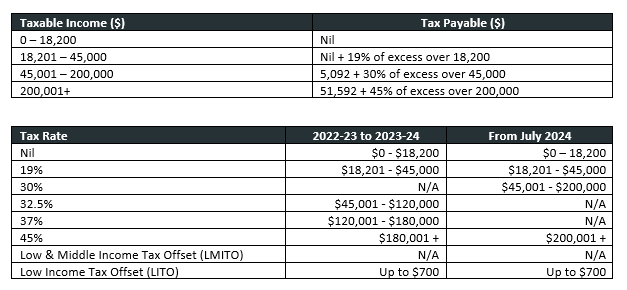

The legislated change will see the introduction of only three personal income tax brackets and rates schedule, rolling the 32.5% and 37% brackets into a single 30% tax rate bracket.

As a result, from 2024-25 and onwards, tax rates and and income thresholds will be as per the following:

Taxation of Digital Currencies & Crypto

The Budget confirmed the Federal Government's intention to introduce legislation clarifying digital currencies (such as Bitcoin) as being excluded from the

Australian income tax treatment of foreign currency.

This announcement reiterates the Government's commitment in treating digital currency as a Capital Asset, and provides further clarity surrounding tax reporting obligations of taxpayers under Capital Gains Tax rules.

Access to Affordable Housing & Further Housing Supply

The Government has announced a new Housing Accord which aims to bring together all levels of government as well as market participants to unlock quality, affordable housing supply over the medium term.

The Housing Accord sets an initial target of 1 million new, well-located homes over five years' from 2024. Under the Accord, the Government is committing $350 million over five years to deliver 10,000 affordable dwellings. States and Territories will also support up to an additional 10,000 affordable homes.

Also announced is the establishment of the "Regional First Home Buyers Guarantee", encouraging home ownership in regional locations. The program allows additional support for eligible citizens and permanent residents who have lived in a regional location for more than 12 months to purchase their first home in that location with a minimum 5% deposit.

The Scheme will see 10,000 places per year under the program to 30 June 2026.

Government Support for Cheaper Child Care

As anticipated ahead of the Budget and with a focus on family, the Government announced that $4.7 billion will be provided over four years from 2022-23 to deliver cheaper child-care.

These measures aim to help ease the cost-of-living for families and encourage greater workforce participation by reducing barriers to re-enter employment following starting a family.

Expansion to Paid Parental Leave

Investment is also being made in the extension of the Paid Parental Leave scheme, with the Government confirming $531.6 million over 4 years from 2022–23 in funds to provide greater support to families. By 2026, families will be able to access up to 26 weeks of Paid Parental Leave.

The Scheme will include reserved ‘use it or lose it’ weeks for each parent, to encourage both parents to take parental leave. Either parent will be able to claim Paid Parental Leave first and both parents can receive the payment at the same time as any employer‑funded parental leave. The reforms also improve flexibility, with parents able to take leave in blocks as small as a day at a time, with periods of work in between.

Support of Businesses |

Fringe Benefit Tax Exemption for Electric Vehicles

One of the biggest announcements to be released in this October Budget focused on the Government's Electric Vehicle Strategy, with funding of $345 million to commence the 'Electric Vehicle Discount' scheme.

Should legislation receive Royal Assent, the Scheme will exempt battery, hydrogen fuel cell and plug-in hybrid electric vehicles from Fringe Benefit Tax and import tariffs where purchased under the luxury car tax threshold for fuel-efficient vehicles.

Under the legislation, employers will need to include exempt electric car fringe benefits' in an employee's reportable Fringe Benefit amount.

Where the Bill becomes law, the FBT exemption will apply retrospectively from 1 July 2022 to eligible vehicles.

Removal for Intangible Assets Depreciation Tax Reform - 2021/22 Federal Budget

The Labor Government will not proceed with tax reform to allow taxpayers to self-assess the effective life of Intangible Depreciating Assets, originally announced in the 2021/22 Federal Budget.

The measure would allow taxpayers to self-assess the tax effective lives of eligible intangible depreciating assets - such as patents, registered designs, copyrights and in-house software. This measure was proposed to apply to assets acquired from 1 July 2023.

Off-Market Share Buy Backs

The Government will improve the integrity of the tax system by aligning the tax treatment of off-market share buy-backs undertaken by listed public companies with the treatment of on-market share buybacks.

This measure is proposed to apply from 7:30pm AEDT, 25 October 2022 (where receiving Royal Assent from Parliament).

Tax Measures for Multinationals

In a specific focus on multinational corporations, the Albanese Government has announced the introduction of extended reporting requirements for relevant companies under its Multinational Tax Integrity Package.

Under the changes to the package, the Government will strengthen Australia's 'thin capitalisation' rules (which apply to taxpayers with overseas operations) to address risks to the corporate tax base arising from the use of excessive debt deductions.

Appling for years starting on or after 1 July 2023, the proposed changes seek to replace the Safe Harbour and worldwide gearings tests with an earnings based assessment to limit debt deductions in line with an entity's activities/profits.

Further transparency from such organisations will also be introduced with new reporting requirements for relevant companies to enhance the tax information they disclose to the public, commencing from 1 July 2023.

Under the change, the Government will require:

- large multinationals to prepare for public release of tax information on a country-by-country basis and a statement on their approach to taxation, for disclosure by the ATO;

- Australian public companies (listed and unlisted) to disclose information on the number of subsidiaries and their country of tax domicile; and

- companies tendering for Australian Government contracts worth more than $200,000 to disclose their country of tax domicile.

ATO Taskforces

The Government has announced it will extend the following ATO compliance programs:

Personal Income Taxation Compliance Program

The Government will provide funding to the ATO to extend its Personal Income Taxation Compliance Program for two years from 1 July 2023.

This extension will enable the ATO to continue to deliver a combination of proactive, preventative and corrective activities in key areas of non-compliance, including overclaiming deductions and incorrect reporting of income.

Shadow Economy Program

The Government will extend the existing ATO Shadow Economy Program for a further three years from 1 July 2023.

The extension of the Shadow Economy Program will enable the ATO to continue a strong and co-ordinated response to target shadow economy activity, protect revenue and level the playing field for those businesses that are following the rules.

Shadow Economy Program

The Government has boosted funding for the ATO Tax Avoidance Taskforce by around $200 million per year over four years from 1 July 2022, in addition to extending this Taskforce for a further year from 1 July 2025.

The boosting and extension of the Tax Avoidance Taskforce will support the ATO to pursue new priority areas of observed business tax risks, complementing the ongoing focus on multinational enterprises and large public and private businesses.

Expanding the Eligibility for Downsizer Contributions

The Government will allow more people to make downsizer contributions to their superannuation, by reducing the minimum eligibility age from 60 to 55 years of age. The measure will have effect from the start of the first quarter after Royal Assent of the enabling legislation.

The downsizer contribution allows people to make a one-off post-tax contribution to their superannuation of up to $300,000 per person from the proceeds of selling their home. Both members of a couple can contribute and contributions do not count towards non-concessional contribution caps.

Further to this, the Government has also announced further (non-tax) measures to reduce the financial impact on pensioners looking to downsize their homes in an effort to minimise the burden on older Australians and free up housing stock for younger families, as follows:

- Extending the assets test exemption for principal home sale proceeds from 12 months to 24 months for income support recipients.

- Changing the income test to apply only the lower deeming rate (0.25%) to principal home sale proceeds when calculating deemed income for 24 months after the sale of the principal home.

Support of Industry and Other Measures |

Immigration & Review of Australian Migration System

The Albanese Government has announced a comprehensive review of the Australian migration system to guide future reforms. Focus of this review has been given to the productivity in processing application, sponsorship opportunities, and establishing an internationally-competitive visa process.

It is hoped these changes help mitigate challenges organisations currently face in filling employment vacanices and allow greater access to talent globally.

An official report on the review is expected to be released by February 2023. Additionally, the Government has also flagged plans to increase the Temporary Skills Migration Income Threshold.

Extended Support for SME Businesses

The Government will provide funding to support small to medium enterprises to fund energy efficient equipment upgrades. The funding will support studies, planning, equipment and facility upgrade projects that will improve energy efficiency, reduce emissions or improve the management of power demand.

Additionally, the Government will provide $15.1 million over two calendar years from 1 January 2023 until 31 December 2024 to extend the Small Business Debt Helpline and the NewAccess for Small Business Owners programs to support the financial and mental wellbeing of small business owners.

Investment in Australian Infrastructure Spending

Announced prior to the Federal Budget, the Treasurer confirmed the release of $9.6 billion in infrastructure spending across Australia. The now confirmed allocated funds aims to assist infrastructure project upgrades throughout various State and Territories, with commitments of $2.2 billion for Melbourne's suburban rail loop, $1.5 billion for Darwin's Middle Arm precinct, $300 million for the Western Sydney roads package, and $586 million for the upgrade to Brisbane's Bruce Highway.

Additionally, Government funding has also been allocated to Tasmania and South Australia, with $685 million and $660 million funding commitments for the improvement of infrastructure projects.

For More Information

For more information on the Albanese Labor Government - Federal Budget 2022/23 and how it will impact you or your SME business, please contact your Archer Gowland Redshaw adviser on (07) 3002 2699 | info@agredshaw.com.au

%20-%20HubSpot%20(1).png)