In the 2016-17 Budget, the Government announced that it will reduce the corporate tax rate progressively from 30% to 25%.

In the 2016-17 Budget, the Government announced that it will reduce the corporate tax rate progressively from 30% to 25%.

The small business company tax rate had already been reduced from 30% to 28.5% from 1 July 2015. The definition of small business for this tax cut was a business with an aggregated turnover of less than $2million.

Legislation has been passed that reduces the company tax rate for a small business entity to 27.5% applying from 1 July 2016. The definition of small business entity for this tax cut, is a business with an aggregated turnover of less than $10million.

Additional small business concessions

More businesses will now be able to access this lower tax rate as well as being able to choose some other small business concessions such as:

- Depreciation concessions

- Automatic write offs

- GST/BAS concessions

- Asset restructure rollover

- Prepayment deductions

Please note the increase in aggregated turnover does not extend to the Small Business CGT concessions – the aggregate turnover threshold for these concessions remain at $2million.

Changes to imputation credits

With the reduction in the company tax rate to 27.5% commencing 1 July 2016, a corresponding change in the level of imputation credits will also reduce to 27.5%. This reduction in imputation credits only applies to dividends paid from a Small Business Entity (SBE).

Franked dividends

Other companies will still pay tax at 30% and payout franked dividends at 30% for FY17. Corporate beneficiaries and investment companies fall into this category.

“Top up” tax will apply in some instances when corporate beneficiaries receive dividend income from a SBE or a Trust that received a dividend from a SBE.

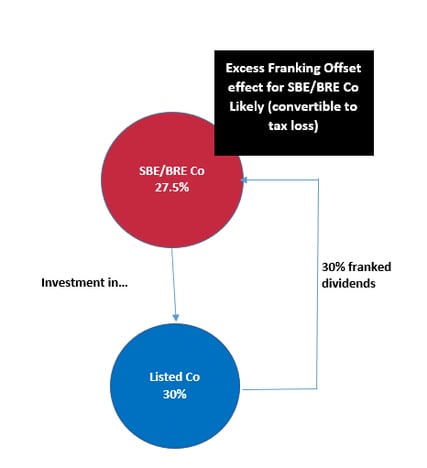

Example 1

SBE companies that receive franked dividends from other companies will have an excess franking credit issue, which may result in these excess credits being converted into a tax loss or used to cover other company tax payable on the trading profits of the SBE.

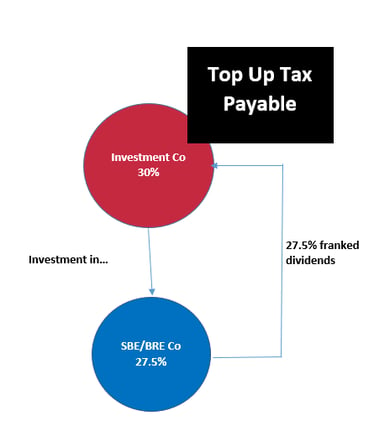

Example 2

Companies will now have to pay additional “top up” tax as well, where the company rate of tax is greater than 27.5%.

Example 3

John is a shareholder of XYZ Trading Pty Ltd - a SBE with a turnover of $5m - that pays him a fully franked dividend of $50,000 during FY17. The imputation credit attached to this dividend is $18,965. John also receives a salary from XYZ Trading Pty Ltd of $100,000 for FY17.

The new tax rate - table

The table below highlights the difference between the old company tax rate of 30% and the new company tax rate of 27.5%. John as an individual taxpayer will pay an additional $1,503 in tax under this example.

|

|

Old (30%) |

New (27.5%) |

|

Dividend (Cash) |

50,000 |

50,000 |

|

Imputation Credit |

21,428 |

18,965 |

|

Tax Payable (39%) |

27,856 |

26,896 |

|

Less: Imputation Credit |

(21,428) |

(18,965) |

|

Net Cash Position |

43,572 |

42,069 |

Based on the new position, consideration needs to be given to which company in a family group will pay dividends to individual family members. Groups that have a SBE and a corporate beneficiary may find it more cashflow effective to pay the dividends from the corporate beneficiary before paying any dividends from the SBE company.

More information

For more information on the changes to small business tax rates and how the changes affect you, please contact Ian Walker on 07 3002 2699 or ianw@archergowland.com.au.

Disclaimer

The information contained in this paper is of a general nature and does not take into account personal circumstances. Before making any decisions based on the factual information contained in this document, please consult with your financial adviser.

%20-%20HubSpot%20(1).png)